'The Mirror'

Meet Paul Peeler‘The Mirror’

Meet Paul Peeler

I grew up in Washington, Georgia.

I grew up in Washington, Georgia.

Washington is a small town about a two hour drive east of Atlanta, in the heart of the Georgia Piedmont. When I was growing up there, the population was about 4,000. Today the population remains about 4,000.

My first job was working for my father and uncle at Meadows IGA. Meadows joined Washington Food Market and the A & P as the handful of groceries in town (If you ever find yourself within sixty miles of Washington, make a detour to Washington Food Market and ask for barbecue and Brunswick stew—trust me on this). By today’s standards it was tiny and would absolutely be engulfed by the nearest Kroger.

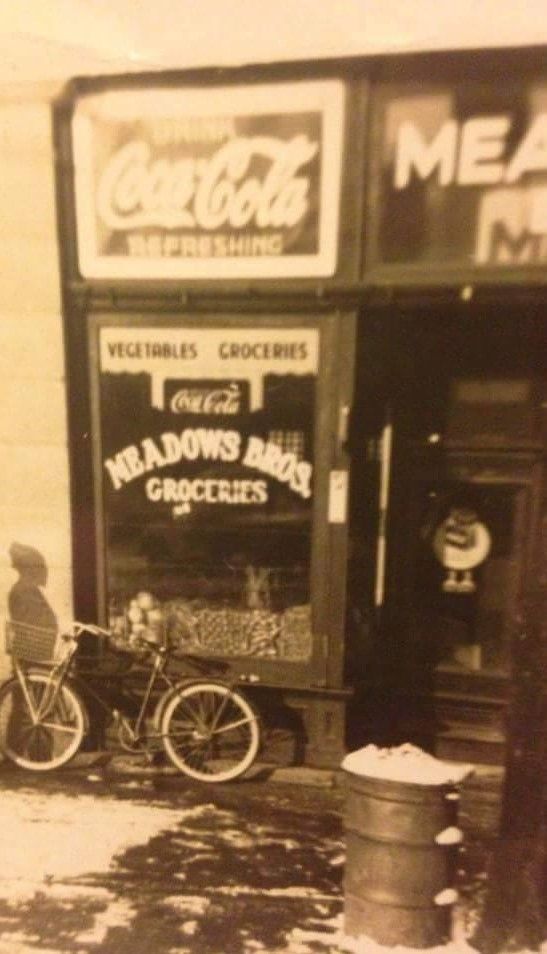

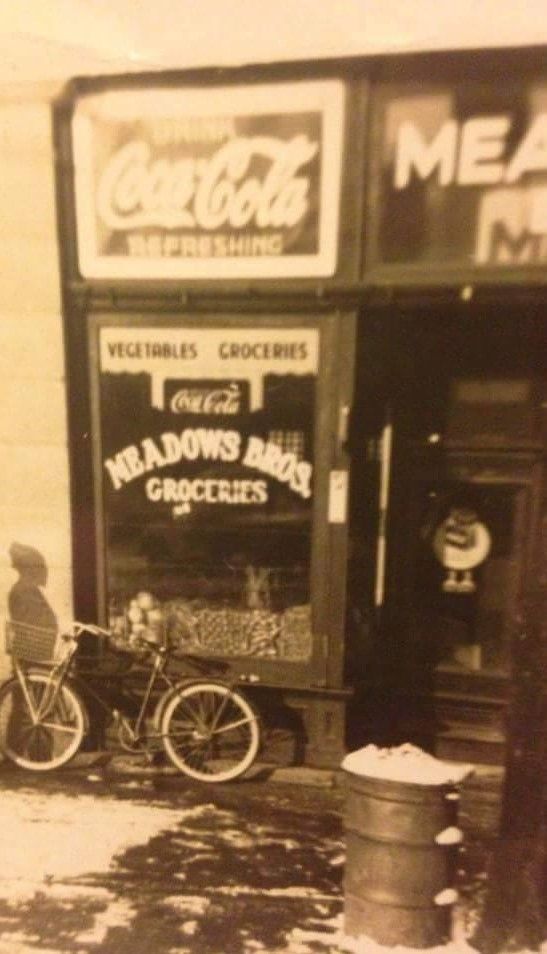

My grandfather and his brother started Meadows. This old photo shows the original location on the town square. It eventually moved, merged with the Foodland co-op, and then ultimately became a part of the IGA chain. The current store shown here looks like it did in 1983, except for the ice machine.

When you’re a kid, everything seems consistent. My Uncle Austin and my father, Paul Sr., ran the store. Scotty ran inventory. Terry ran the produce department (today Terry owns the store under the name Terry’s IGA). Mr. Bufford and Mr. Scott were the butchers. Loretta was a longtime cashier and was sometimes joined by my grandmother. This was in the time before scanners, when you had to key in every item. Dozens of young men rotated in and out over the years as stock clerks and bagboys. My sister, cousins, and I worked there from my earliest memories.

One of the things I took away from working for my dad and uncle in a grocery store in a small town is this practice of taking care of people: looking out for them and doing right by them. In a small town you really don’t have a choice.

Now this idea wasn’t a lesson that was drilled into me directly. It was just the way things were done. When folks couldn’t pay for groceries, my uncle would run a tab. They’d pay when they could. When an elderly customer was under the weather and couldn’t get to the store, we’d take their order by phone and drive the goods over. If folks had other stops to make while in town, we’d hold their groceries in the back cooler so their milk wouldn’t spoil in the oppressive Georgia heat. And I couldn’t begin to tell you the amount of food that was donated to local schools, clubs, and Sunday school classes.

Now this idea wasn’t a lesson that was drilled into me directly. It was just the way things were done. When folks couldn’t pay for groceries, my uncle would run a tab. They’d pay when they could. When an elderly customer was under the weather and couldn’t get to the store, we’d take their order by phone and drive the goods over. If folks had other stops to make while in town, we’d hold their groceries in the back cooler so their milk wouldn’t spoil in the oppressive Georgia heat. And I couldn’t begin to tell you the amount of food that was donated to local schools, clubs, and Sunday school classes.

One drawback to large investment firms today is that most things are reduced to numbers. I get that. These companies must meet certain metrics to satisfy their responsibilities to the shareholders. But if they are not careful the interests of the client get left out the mix. Sure, “putting the client first” is often a value statement emblazoned on a website or printed in a glossy annual report. But my other grandfather told me to look past what people say and watch what they do.

One of my favorite corporate experiences was working for a large national brokerage company. When I was hired in 1995, the internal mantra was, “We are the custodians of our client’s dreams”. I thrived in that environment. I suspect it was because that ethic in a way mirrored my foundational experiences growing up. Then the founder and chairman stepped aside and in no time the conversation changed to “share of wallet.” Again, I get that. Metrics are important. But I blanched at elevating these metrics over the humanity of families we were impacting. I suspect it is not a coincidence that my tenure with this firm ended shortly after.

When I was in my twenties, an older gentleman I respected once told me, “You can’t belie your raisings.” I think he meant it pejoratively. That’s how I took it anyway, and I mistakenly spent the succeeding decades trying to distance myself from where I came from. Modern business teaches you to do that. You must look a certain way. You must sound a certain way. No wonder I often felt like I was wearing a mask.

It only took me three decades to realize that my success comes from the very values that were instilled in me while working at Meadows as a kid. I own the business I work in; the buck stops with me. Some might accuse me of not charging enough—I’d just call it a fair price. I make house calls for clients who have difficulty getting out. I believe the word “fiduciary” actually means something. And if a client doesn’t buy into my philosophy, I’m not going to tell them what they want to hear just to keep them.

It only took me three decades to realize that my success comes from the very values that were instilled in me while working at Meadows as a kid. I own the business I work in; the buck stops with me. Some might accuse me of not charging enough—I’d just call it a fair price. I make house calls for clients who have difficulty getting out. I believe the word “fiduciary” actually means something. And if a client doesn’t buy into my philosophy, I’m not going to tell them what they want to hear just to keep them.

Some may say that doesn’t make good business sense, because it keeps the metrics from being optimized. That’s OK.

My dad used to tell me, “Son, when it’s all said and done, the only person you really answer to is that guy staring back at you in the mirror.”

I can live with that.

I grew up in Washington, Georgia.

Washington is a small town about a two hour drive east of Atlanta, in the heart of the Georgia Piedmont. When I was growing up there, the population was about 4,000. Today the population remains about 4,000.

My first job was working for my father and uncle at Meadows IGA. Meadows joined Washington Food Market and the A & P as the handful of groceries in town (If you ever find yourself within sixty miles of Washington, make a detour to Washington Food Market and ask for barbecue and Brunswick stew—trust me on this). By today’s standards it was tiny and would absolutely be engulfed by the nearest Kroger.

My grandfather and his brother started Meadows. This old photo shows the original location on the town square. It eventually moved, merged with the Foodland co-op, and then ultimately became a part of the IGA chain. The current store shown here looks like it did in 1983, except for the ice machine.

When you’re a kid, everything seems consistent. My Uncle Austin and my father, Paul Sr., ran the store. Scotty ran inventory. Terry ran the produce department (today Terry owns the store under the name Terry’s IGA). Mr. Bufford and Mr. Scott were the butchers. Loretta was a longtime cashier and was sometimes joined by my grandmother. This was in the time before scanners, when you had to key in every item. Dozens of young men rotated in and out over the years as stock clerks and bagboys. My sister, cousins, and I worked there from my earliest memories.

One of the things I took away from working for my dad and uncle in a grocery store in a small town is this practice of taking care of people: looking out for them and doing right by them. In a small town you really don’t have a choice.

Now this idea wasn’t a lesson that was drilled into me directly. It was just the way things were done. When folks couldn’t pay for groceries, my uncle would run a tab. They’d pay when they could. When an elderly customer was under the weather and couldn’t get to the store, we’d take their order by phone and drive the goods over. If folks had other stops to make while in town, we’d hold their groceries in the back cooler so their milk wouldn’t spoil in the oppressive Georgia heat. And I couldn’t begin to tell you the amount of food that was donated to local schools, clubs, and Sunday school classes.

One drawback to large investment firms today is that most things are reduced to numbers. I get that. These companies must meet certain metrics to satisfy their responsibilities to the shareholders. But if they are not careful the interests of the client get left out the mix. Sure, “putting the client first” is often a value statement emblazoned on a website or printed in a glossy annual report. But my other grandfather told me to look past what people say and watch what they do.

One of my favorite corporate experiences was working for a large national brokerage company. When I was hired in 1995, the internal mantra was, “We are the custodians of our client’s dreams”. I thrived in that environment. I suspect it was because that ethic in a way mirrored my foundational experiences growing up. Then the founder and chairman stepped aside and in no time the conversation changed to “share of wallet.” Again, I get that. Metrics are important. But I blanched at elevating these metrics over the humanity of families we were impacting. I suspect it is not a coincidence that my tenure with this firm ended shortly after.

When I was in my twenties, an older gentleman I respected once told me, “You can’t belie your raisings.” I think he meant it pejoratively. That’s how I took it anyway, and I mistakenly spent the succeeding decades trying to distance myself from where I came from. Modern business teaches you to do that. You must look a certain way. You must sound a certain way. No wonder I often felt like I was wearing a mask.

It only took me three decades to realize that my success comes from the very values that were instilled in me while working at Meadows as a kid. I own the business I work in; the buck stops with me. Some might accuse me of not charging enough—I’d just call it a fair price. I make house calls for clients who have difficulty getting out. I believe the word “fiduciary” actually means something. And if a client doesn’t buy into my philosophy, I’m not going to tell them what they want to hear just to keep them.

Some may say that doesn’t make good business sense, because it keeps the metrics from being optimized. That’s OK.

My dad used to tell me, “Son, when it’s all said and done, the only person you really answer to is that guy staring back at you in the mirror.”

I can live with that.

2023 Stewardship Award

Paul Peeler was named the 2023 recipient of Integrated Financial Group's Lorie Moore and Chuck Nida Stewardship Award at IFG's 2023 conference, which took place January 19th - 21st at The Hotel at Avalon in Atlanta.

"Paul’s work and heart for families facing severe mental illness is a new frontier for the financial services industry," said Land Bridgers, CEO of Integrated Financial Group. "Paul is leading the way with The Preparedness Project and leaning into this underserved, but growing population in America. Thank you Paul for taking your real life struggles and using it to impact others in a huge way. On behalf of everyone at IFG, thank you for leading by serving!"

Out of Office Gallery

If you ever get an out of office notification from me saying I don’t have access to email, I’m likely somewhere enjoying the outdoors and some quiet, reflective time. I like photography as well, and how my pictures help me remember the importance of these trips in fostering my own well-being, freedom, and progress.