Understand the IRS’s calculations and tables.

As much as you would like to, you can’t keep your money in your retirement account forever.

These investment vehicles include 401(k)s, IRAs, and similar retirement accounts.1 Under the SECURE Act, once you reach age 72, you must begin taking required minimum distributions from your 401(k), IRAs, or other defined contribution plans in most circumstances. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Another major change that occurred from the SECURE Act is the removal of the age limit for traditional IRA contributions. Before the SECURE Act, you had to stop making contributions at age 70½. Now, you can continue to make contributions as long as you meet the earned-income requirement.2

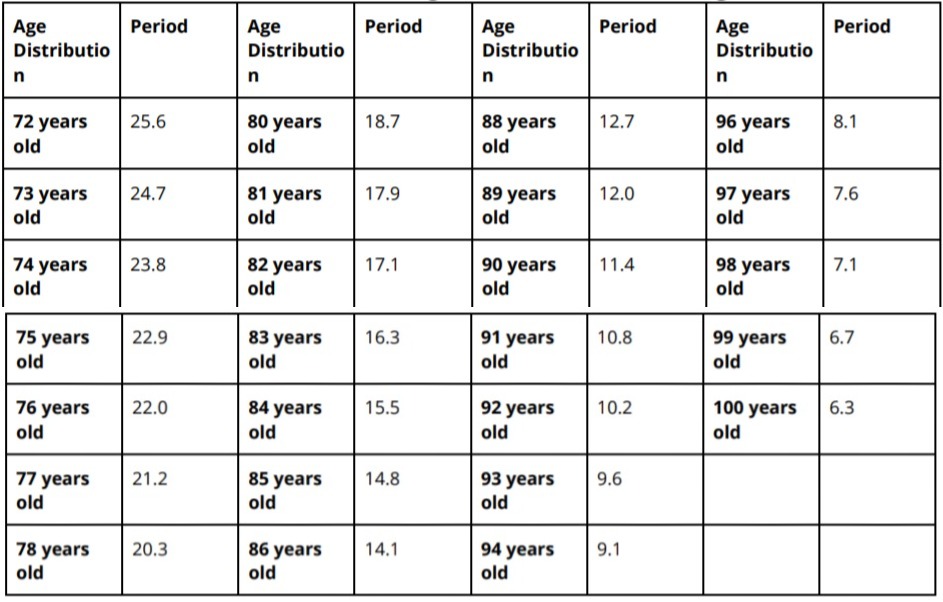

How do you determine how much your RMD needs to be? It depends on whether or not you’re married, and if you are, if your spouse is the sole beneficiary of your IRA and less than 10 years younger than you are. For everyone else, the Uniform Lifetime Table can help.

Keep in mind that this article is for informational purposes only, and the table below is meant to provide some guidance. The table is neither a recommendation nor a replacement for real-life advice. Always contact your tax, legal, or financial professional before making any changes to your required minimum distributions.

Uniform Lifetime Table (additional ages can be found on IRS.gov)

You can use the following formula to calculate a rough estimate of your RMD:

1. Determine the year-end balance of your account

2. Find your age on the table and note the distribution period number.

3. Divide the total balance of your account by the distribution period. For example, say you’re 72, and your account balance is $100,000. Your RMD may be about $3,906, based on the table.

Calculating your RMD isn’t tricky, but understanding your RMD’s role in your overall retirement strategy can be complicated. It’s important to note that penalties can apply if you don’t follow the mandatory distribution guidelines. A financial professional is an excellent resource for guidance.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party nor their affiliates. This information is derived from sources believed to be accurate. Please note: investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting, or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax, or legal advice and may not be relied on to avoid any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Citations

1. IRS.gov, September 23, 2020

2. NerdWallet.com, November 26, 2020

3. Internal Revenue Service IRA Required Minimum Distribution Worksheet, 2020